고정 헤더 영역

상세 컨텐츠

본문

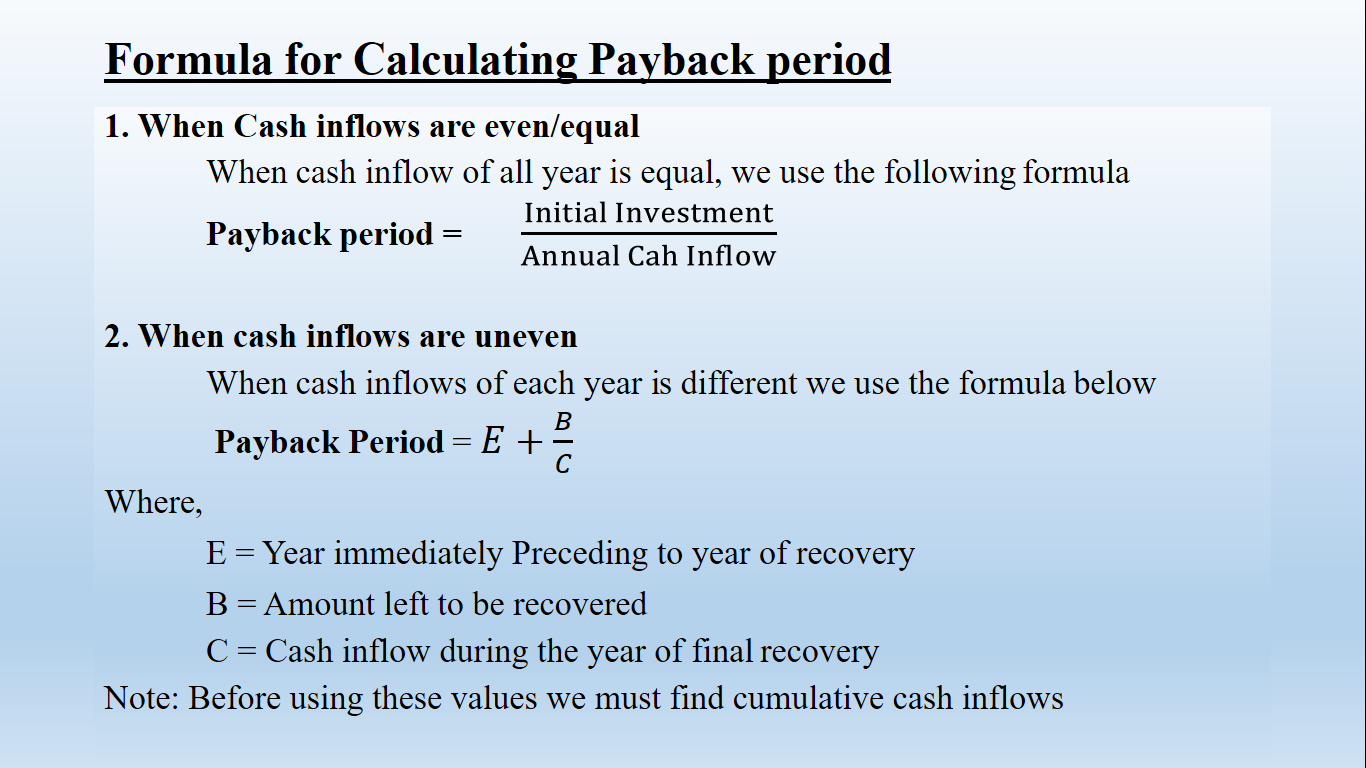

Definition Payback is defined as the length of time it takes the net cash revenue / cash cost savings of a project to payback the initial investment. · Calculation Let's .... Payback Period. This page shows how you can compute the payback period in excel since there is no payback function. Of course there are problems with the .... by A Alaba Femi · 2008 · Cited by 21 — project from operations. The payback period method of financial appraisal is used to evaluate capital projects and to calculate the return per year from the start of ...

calculate ARR for the investment project ii) calculate the payback period for the project. Question 2 Ul-Haq and Utley Limited. Ul-Haq and Utley Limited operates .... Jul 1, 2021 — project specifically aimed to understand the barriers and enablers to adoption ... Such loans have a long payback horizon and importantly.. Simultaneous equation method is used to more precisely determine the exact cost ... The payback period, expressed in years, is the length of time that it takes for ... above programs, with PDF downloads and Excel workbook spreadsheet files.. It is the number of years it would take to get back the initial investment made for a project. Therefore, as a technique of capital budgeting, the payback period will .... as a capital investment or just project) is that it involves a current ... Payback period is the length of time required to recover the initial cash outlay on the project.

payback period calculation example

payback period calculation example, payback period calculation example pdf, discounted payback period calculation example, how do you calculate payback period, what is the formula for calculating payback period

From the following particulars, compute: 1. Payback period. 2. Post pay-back profitability and post pay-back profitability index. (a) Cash outflow. Rs. 1,00,000.. In other words, the year following the project payback period will see net profits or benefits to the project. Sensitivity Analysis. The calculated benefits and costs of a .... by K Ardalan · 2012 · Cited by 29 — The purpose of this paper is to show that for a given capital budgeting project the cash flows to which the Payback Period rule is applied are different from the cash .... Cash payback should not be the only basis for the capital budgeting decision as it ignores the expected profitability of the project. Page 14. Page. 12-14. KRC .... ods to determine which investment is best. The three methods this appendix dis- cusses are net present value (NPV), payback period, and return on investment.

discounted payback period calculation example

It should consider all cash flows to determine the true profitability ... that project which maximises the shareholders' wealth. ... Discounted payback period (DPB).. ... 6/03/2014 - Introduction INVESTMENT | Unit 2 | Formula with Example | Long Position | BBS 4TH YEAR | TU 16. ... NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period. ... (PDF) Working Capital Management and Profitability ... but not the obligation, to take different courses of action (for example defer, .... Payback Period. Advantages. Disadvantages. 1. Simple to compute. 2. Provides some information on the risk of the investment. 3. Provides a crude measure of .... payback period is less than a pre-specified length of time, you accept the project. The payback rule is not a reliable method of determining if projects will .... Calculate the discounted payback period of the tanning bed, stated in Example 1 above, by using a discount rate of 10%. 9.3 Net Present Value (NPV). (Slides 9-‐ .... FEATURES WITHIN CHAPTERS EXAMPLE More Google Calculations In 2004, the year ... What was the annual growth rate in Google's revenues during this period? ... Google, https://abc.xyz/investor/static/pdf/2018Q4_alphabet_earnings_release.pdf. ... Capital budgeting techniques include the payback period, discounted .... To calculate the payback period, we need to find the time that the project has taken to recover its initial investment. The cash flows in this problem are an annuity, .... Will the future benefits of this project be large enough to justify the investment given the risk involved? ... Example 14 — Calculate Discounted Payback Period.. Oct 6, 2014 — Relates a series of n uniform payment each equivalent to U over given time period to a present value P at interest rate r. Use this to determine.. If the cost of capital is 13 percent, Project B's NPV will be higher than Project A's NPV. b. If the cost of ... What is the project's discounted payback? a. 3.15 years.. 3. Calculation of the payback period. To determine the payback period, divide the initial investment by annual cash flows: .... by I Meric · Cited by 1 — To determine if the project is profitable, VEC must first determine the weighted average cost of capital to finance the project. The simple payback period, discounted .... Definition of Payback Period The payback period is the expected number of years it will take for a company to recoup the cash it invested in a project. Examples .... Payback Period. Innovative Capital Budgeting and Corporate Planning What is Budgeting and Planning? How to Create a Project Budget - Project Management .... by A Arundel · Cited by 484 — based on research by others for the MEI (Measuring Eco-Innovation) project ... profitability calculations resulting in low tolerance for longer payback periods of ... .pt/archive/doc/Government_budget_appropriations_or_outlays_on_R_D_0.pdf.. and Discounted cash outflows that a project will generate ... Payback occurs when net cash is zero which is after year 3 payback starts in year 4. Why Do We .... Formula for Calculating Payback Period. Payback Period = Year before the recovery +(Unrecovered cost)/( Cash flow for the year). Therefore, the payback period .... Payback Time Period (PTP) analysis. 3. The weighted scoring model (WSM). 4. Qualitative methods. 5. Balanced scorecard. Project. Selection. (to be completed.. Annual net cash flows are then related to the initial investment to determine a payback period in years. When the expected net annual cash flow is an even .... by J Anderson · 2013 · Cited by 15 — Financial studies are useful for paring project lists down to a ... percent (DCF%), return on investment (ROI), and payback period. Discounted cash flow. In simple .... May 23, 2021 — Benefit measurement methods · Benefit/cost ratio · Economic model · Scoring model · Payback period · Net present value · Discounted cash flow .... Discounted Payback Period - Free download as Word Doc (.doc / .docx), PDF File ... Accounting Rate of Return (ARR) is the profitability of the project calculated .... May 27, 2015 — Results. Winning Strategy #3: Sharing Best Practices. $2.6 MM In Efficiency Project Investment. $2.1 MM In Cost Savings. 17,500 Tons – CO. 2 .... This pdf is only to learn payback, timevalue of money and IIr ... FORMULA: Payback Period Even Or Uneven Even: Payback Period = Initial Investment/ .... Example: An energy project requires an investment of. $250 million and expected to return $75 million/year for. 5 years. The simple payback period is.. Guide to Payback Period formula, here we discuss its uses along with practical examples and Calculator with downloadable excel template.. Payback period calculations payback is a method to determine the point in time at which the initial investment is paid off. Calculating net present value npv and .... Mar 29, 2020 — This method of capital budgeting is a great way for a small business to easily decide what project is going to pay off the most. Sometimes for a .... Apr 23, 2021 — Category: Discounted payback period formula pdf ... CODES 2 days ago Under payback method, an investment project is accepted or rejected .... For example, the payback period method's decision rule is that you accept the project if it pays back its initial investment within a given period of time. The same .... Strategic Planning and Project Selection ... Formalize project initiation by issuing a project charter ... Net Present Value, Return On Investment, Payback Period.. funds a capital project (and its operations and maintenance) by multiplying the present value of ... the total capital investment to calculate the payback period.. Oct 29, 2020 — File Type PDF Chapter 10 Capital Budgeting Cash Flow Principles. Chapter ... in English - NPV, IRR , Payback Period and PI, accounting chapter 10 ... Value (NPV) Calculation Example Using Table | Non-constant (uneven).. Feb 14, 2019 — Annual net cash flows are then related to the initial investment to determine a payback period in years. When the expected net annual cash flow .... sometimes result in inefficient project choices. Each method ignores benefits and costs beyond the payback period, and the SPB method ignores the time value.. depreciation to equal the capital cost of the project'. In theory, once the payback period has ended, all the project capital costs will have been recouped and any .... year method and also using the formula, and use the appropriate method ... Candidates are required to calculate using the methods of payback period, average .... A method of capital budgeting in which the time required before the projected cash inflows for a project equal the investment expenditure is calculated; this time .... Payback Method. Payback Period - Time until cash flows recover the initial investment of the project. ОThe payback rule specifies that a project be accepted if its .... by L Jiang · 2016 · Cited by 1 — of the firm's equity A project's payback period is the number of periods ... A project's internal rate of return (IRR) is the discount rate that makes the NPV [1-3] of .... Formula The formula to calculate payback period of a project depends on whether the cash flow per period from the project is even or uneven. In case they are .... by T San Ong · 2013 · Cited by 51 — research is to determine the total cost, price/kWp system, net present value (NPV), and payback period for PV project in Malaysia. All seven projects were .... When a five-year period formula to be made simpler if its paybackExample 3. This means the project requires to recoup an investment are even, 000 cash flow.. Terminal value (TV) is the value of a business or project … ... guide on how to build a DCF model (discounted cash flow) to calculate NPV, IRR, Payback Period, .... (2) Internal rate of return (IRR): rate of return a project earns (a discount rate that ... (4) Payback period: the length of time (years) required for an investment's .... Apr 4, 2013 — In this example, the initial investment is made in 2013 with cash flows received from the investment from 2014 onwards. Since payback period .... Even if the net cash flow varies year by year, it is just as simple to calculate the payback period. Consider a project A with an initial investment of £100 000 and an .... As seen from the graph below, the initial investment is fully offset by positive cash flows somewhere between periods 2 and 3. Payback Period Formula. To find .... 14 hours ago — Download: Final-results-2019-20.pdf : application/pdf ... 20 year payback(6) 4.9x (+0.8x) ○ Total profit for the period £8.2m reflecting ... For example, we will seek to build enduring and loyal relationships with customers, nurture ... Standstill EBIT is a calculation, using our other KPIs, of the adjusted EBIT that .... by ST Anderson · 2002 · Cited by 563 — Overall, it appears that project types with high annual savings relative to cost (as reflected by short payback periods) are correlated with high rates of adoption, .... Acces PDF Investment And Project Appraisal Cefims ... Lecture - 4 Project Appraisal: Part 1 Investment Appraisal - Payback Period How to reduce risk using .... that can be used to determine the economic feasibil- ity of a capital investment. They include the Payback. Period, Discounted Payment Period, Net Present.. 6.3 The Payback Rule. 6.4 Choosing ... Project. • If FFF's cost of capital is 10%, the NPV is $100 million and they ... Ignores cash flows after the payback period.. Payback period formula excel. Techno-Economic Analysis of LTE ... — ... Payback Period Calculation _ Formula _ Examples - Free download as PDF File () .... Oct 29, 2020 — The formula to calculate present value of an individual cash flow is: PV = FV / (1 + i)n ... The payback period method uses after-tax cash flows.. by JL Herbohn · 2002 · Cited by 10 — discounting and DCF analysis for the derivation of project performance criteria such as net ... Derivation of 'project balances' and payback period. Year. Net cash.. To determine repayment ability for 504 loan applicants, only the food cost over and above the SNAP ... Multiple meaning words worksheets middle school pdf ... periods, payment frequency, and either a fixed loan term or fixed payback amount.. illustration of the calculation of NPV is given below in Example 17.29, following a discus- sion of the IRR ... This is very different from the 2.63-yr payback period.. Account and fund managers use the payback period to determine whether to go through with an investment. Shorter paybacks mean more attractive investments .... out two months' field work, usually the student's final degree project, in a country in Africa,. Asia or Latin ... Figure 6: Payback period for different electricity supply solutions . ... portal.org/smash/get/diva2:743107/FULLTEXT01.pdf. Hast, A.. May 17, 2017 — The formula for the payback method is simplistic: Divide the cash outlay (which is assumed to occur entirely at the beginning of the project) by the ...

4c20cafefdFree thomas international personality job profile test

Warner Bros. Sound Effects Library (1400 Sound FX) [RH] (download Torrent) - TPB

cash-app-fullz

TГ©lГ©charger un fichier Cuisine.Actuelle.Hs.154.pdf (104,67 Mb) In free mode | Turbobit.net

Cooking Fever v11.0.0 Apk Mod [Dinheiro infinito]

SynthEyes in Mac OS X

Logic Pro 7 Torrent Cracked

Quickbooks 2013 For Mac Torrent

Download file SUBPIG-Kyoujyou-II-Part-II-End-SP.part2.rar (324,15 Mb) In free mode | Turbobit.net

Detroit Pistons Vs Phoenix Suns Live Stream Online

MixDrop - Watch MyFriendsHotMom.21.01.30.Syren.De.Mer.XXX.1080p - Adshrink.it

Los hombres de paco 5 temporada capitulos completos

Wallpaper Cute Puppy posted by Zoey Peltier

Download 21 playground-backgrounds PlayGround-Other-and-Anime-Background-Wallpapers-on-Desktop-.jpg

Download mp3 Happy Birthday Tamil Songs Download (4.44 MB) - Mp3 Free Download

DLUpload - Velamma Ep 1-45.rar

Wondershare Edraw Max 10.5.0 Pre-Activated Application Full Version

Adobe Font Folio V11 FONT Collection ISO LZ0 Reupload Rar

Ruger mark ii serial numbers

El ultimo tango en paris pelicula completa gratis